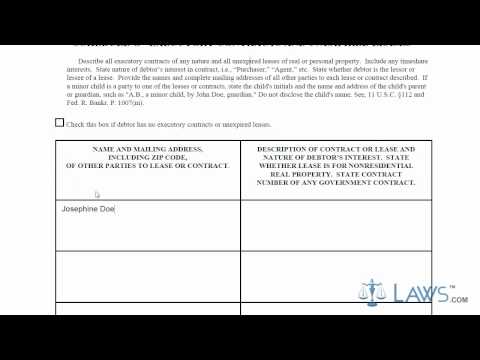

Laws calm legal forms guide when filing for bankruptcy. There's a lot of paperwork required to initiate the filing process before your bankruptcy case can begin. However, you must fill out the necessary forms and file them with the United States Bankruptcy Court for your respective district. Once the particular court has approved the filing, your bankruptcy case can begin. - One particular form which commonly gives individuals trouble is the form b-6g schedule g. This form requires a few basic pieces of information to expedite the process of filling out the bankruptcy schedule. - The form b-6g schedule g possesses several components. The first part of the form features executor e contracts, which are essentially contracts that have been signed where the individual promises to pay or receive payment for a service in the future. For example, hiring a contractor to build a house would be a common example of an executor e contract. All contracts with these characteristics must be listed on this portion of the form. Additionally, when listing the contract, you are required to declare your relationship to the contract, whether you were the purchaser or the contractor. - The second part of the form b-6g schedule g covers unexpired leases. These contracts refer to any rental or lease agreement where the person declaring bankruptcy is a fundamental part. These agreements are active and must be renewed in writing. Examples of unexpired leases include timeshare property as well as numerous real estate transactions. Similar to the first part of the schedule g, this portion requires you to fill in your relationship to the contract, its expiration date, and other relevant details. - To watch more videos related to this topic, please make sure to visit laws calm.

Award-winning PDF software

Irs schedule g 2025 Form: What You Should Know

See Tax Information For Individuals 2017 Information For Individual Filers Note: Information for the 2025 tax year was submitted electronically until Jan. 31, 2018. Schedule G Rev 2—Information filed electronically: Separate form for corporations and LCS. (PDF) Results 1 – 8 of 83 — Form 1120 (Schedule G), Information on Certain Persons Owning the U.S. Personal Holding Company (PHC) Tax, 1216, 01/10/2017. See Tax Information For Individuals 2017 Information For Individual Filers — Volumes 1 and 2 See Tax Information For Individuals Schedule G Rev 1—Information filed electronically: Separate form for partnerships. (PDF) Results 1 – 10 of 84 — Form 1120 (Schedule G), Information on Certain Persons Owning the U.S. Personal Holding Company (PHC) Tax, 1216, 01/10/2017. See Tax Information For Individuals 2017 Information For Individual Filers — Volumes 1 and 2 Results 8 – 22 of 85 — Forms 990-R and 990-EZ, Business Holdings. (PDF) See Tax Information For Individuals Results 8 – 23 of 85 — Form 1120 (Schedule G), Information on Certain Persons Owning the U.S. Personal Holding Company (PHC) Tax, 1216, 01/10/2017. See Tax Information For Individuals Results 6 – 37 of 87—Form 990 (or 990-EZ), Schedule C, Employer's Quarterly Federal Income Tax return, 2025 and 2025 and Form W-2, Wage and Tax Statement for Self-Employment Income, 2025 and 2011. (PDF) See Tax Information For Individuals Results 1 – 23 of 89—Form 990-EZ, Schedule C, Employer's Quarterly Federal Income Tax return, 2025 and 2025 and Form W-2, Wage and Tax Statement for Self-Employment Income, 2025 and 2011. See Tax Information For Individuals Results 1 – 24 of 89—Form 990-EZ, Schedule D, Employer's Quarterly Federal Income Tax return, 2025 and 2010, and Form W-2, Wage and Tax Statement for Self-Employment Income, 2025 and 2011. See Tax Information For Individuals Results 1 – 4 of 89—Form 990-EZ and Form 1120, information on the individuals and corporations that own U.S.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 990 (Schedule F), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 990 (Schedule F) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 990 (Schedule F) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 990 (Schedule F) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs schedule g 2025